Emerald’s Education Series: Emergency Funds and Who Needs One

Emerald’s Education Series: Emergency Funds

It’s late, and you are lying in bed sleeping. You feel something wet on your forehead. A drop of water lands, then another. You groggily open your eyes and question the faint water ring on the ceiling. Your heart starts pounding as you begin to sit up. Then you hear the material ripping above you as the ceiling bursts and water comes pouring onto your bed. That’s when you wake up startled and wonder how you would cover the cost of such an emergency.

Regardless of age or life stage, you will likely experience an emergency and need access to emergency funds. A broken bone, a car wreck, or an unexpected death in the family can happen to anyone. These are times when having access to emergency funds is essential. Here we will discuss emergency fund basics for those starting, those experiencing changing life circumstances, and those needing a higher amount set aside were something to happen.

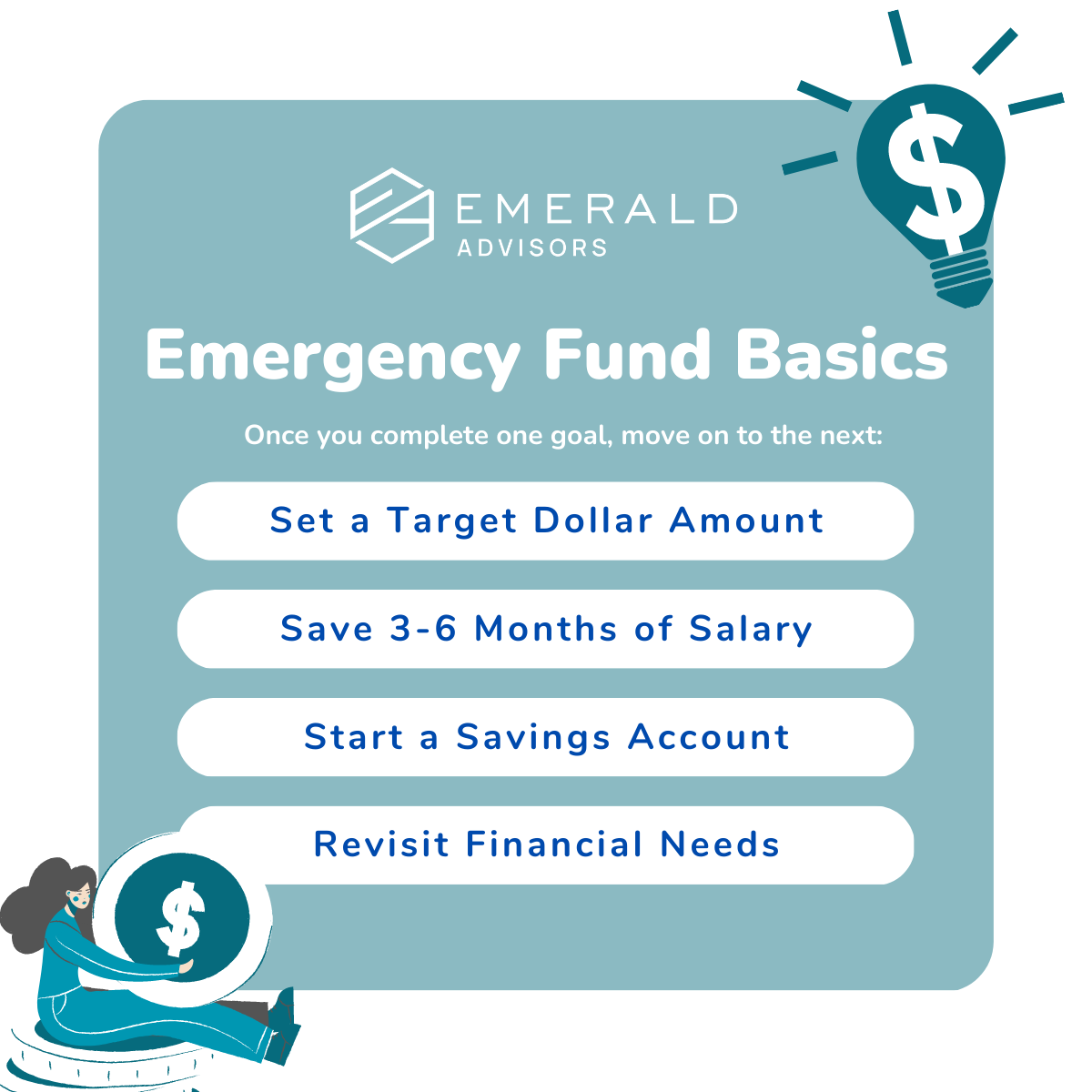

The basics.

Because life happens, everyone needs an emergency fund. When deciding how much is needed for an emergency fund, a general rule is to have 3-6 months of wages set aside or more depending on your lifestyle and needs. For example, a single person living alone will most likely need a smaller emergency fund than a family of four. For those just starting, we recommend setting a dollar amount as your first target to encourage the habit of saving. Then, you can increase that dollar amount and work towards the 3-6 months savings rule.

If you feel unsure about where this money can come from, check your budget to see where you may be able to cut back on luxury/non-essentials to save instead of spend. Do you get a bonus? Put some of it in the pot. Someone gives you a cash gift? Put it in the pot. Once you have reached your emergency fund goal, take the money you used to put away in your emergency fund and now direct it to a savings account or, better yet, increase your retirement savings! You have already developed the saving habit, so why not use it?

Avoid complacency creep

You have saved your 3-6 month goal and are putting money aside for savings. Next, you have a baby, buy a house and a new car. What it takes to pay your monthly bills has increased exponentially, yet your emergency fund hasn’t been boosted to accommodate these increases.

You may think your job promotion will keep enough money in the bank to compensate for any lack of emergency funds. But this is faulty thinking. This is the perfect time to go back to bulking up that fund. A good reminder is to revisit your 3-6 month financial needs every two to three years as circumstances change often, and it’s easy to forget to take steps to prepare for those changes.

Don’t let the past fool you

As a person’s income grows, so can reliance on that income to fund lifestyle choices. In younger years, maybe the salary was in the five digits. Years were spent working hard, saving, and moving up to making a larger salary and receiving compensation benefits. Your current season may be the last decade of solid earning years. Being healthy and fit, and able to handle most challenges is important. Emerald encourages all clients to live below their means when possible. That doesn’t mean we don’t encourage celebratory trips, buying a second home, or treating yourself. It does mean that if you can develop this habit early on, it will be easier to maintain, no matter your income.

But let’s flip the script. The company you work for must downsize and demote or lay off employees. Now, years later, retirement is closer than starting a new career. That emergency fund will be useful if you fall into the reduction category. Things like age and profession can be critical in how much is needed for emergencies.

An emergency fund may seem unnecessary for clients with access to other assets. But the reality is that it is necessary. No one can predict the future, but you can make choices today that may bring greater peace of mind in the future. Emerald Advisors helps clients think ahead and plan for such events. No one wants the worst to happen, but sometimes it does. Having a plan and sticking to it can alleviate a lot of stress that arises in moments like this.

If you are interested in discussing this type of fund or would like to help someone you know to get started, book an appointment today. And remember, emergencies don’t wait until you are prepared to happen, so why not get started sooner rather than later?

Disclosure: Emerald Advisors, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

©Emerald Advisors, 2023