When History Seems to Repeat Itself

April 1, 2023

The past few weeks have seen some categorical banking events. The collapse of Silicon Valley Bank (SVB), accompanied by a swift response from the Federal Deposit Insurance Corporation (FDIC) followed by the UBS rescue of Credit Suisse, are topping most headlines. As with any major event, ripples have been felt in the U.S. and abroad.

How did these events transpire?

In March, we sent an email to clients discussing SVB and its unique position of serving private companies, many in the tech field, and the factors involved in creating the bank run. Between zero interest rates, unprecedented Fed hikes, slow growth in the tech sector, which required more liquidity, and what can be considered a major error in risk management, the combined impact led to the collapse. If you lived through the financial crisis of 2008, the recent bank run might be causing flashbacks to the fall of Lehman Brothers, as there are some similarities. However, the FDIC’s prompt response has been seen as a positive step greatly differing from 2008. More recently, the buyout of Credit Suisse by UBS is considered part of the contagion effect. Reliance on funds from the National Bank of Saudi, Credit Suisse’s top investor, offered no assistance in this time of need. Both banks were in unique situations which contributed to their downfall.

What does the future look like for banks?

The response from the FDIC was meant to send a strong message to financial institutions and consumers alike. America’s largest banks learned from the financial crisis of ’08. These banks now have a much stronger level of capitalization which differs from the two banks above. These banks also undergo stress testing regularly to ensure appropriate risk levels.

The banking system is stronger than it was in the past. No doubt, regulators will be answering questions about their regulatory jobs and the safety mechanisms in place. Still, it is worth noting that these two banks’ failures are not reflective of the banking system as a whole. Each bank had its own unique set of circumstances that triggered its collapse[i]. The banking system is still a safe place for your deposits, and we would encourage you not to give into the hype but to keep deposits in place.

Market volatility, an unwelcome visitor

We wish we could see the future and know when things will settle down. However, none of us have that insight. Instead, we must keep entertaining the unwelcome visitor —market volatility. Like an unwanted house guest, it’s good to acknowledge its presence but not let it dictate your actions based on it hanging around. This is why it’s good to go back to what we said at the start of the pandemic when the market was a pretty wild ride — stay calm and carry on.

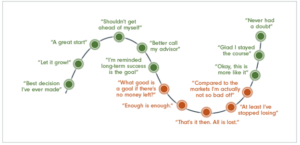

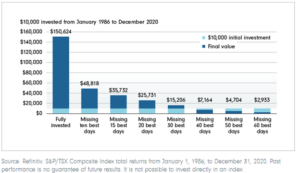

We know it’s easy to say these statements but difficult to adhere to. That’s why we wanted to share these two graphs. One is a humorous look at the very real emotions we all experience during times of volatility. The other graph shows what can happen if we let our emotions direct our actions.

Emerald Advisors is not in the business of trying to time the market. Instead, we are interested in approaching the market from a disciplined position, not swayed by emotions but rather moved by a plan and your goals. Even though we have said it before, it’s worth saying again that we advise and practice diversification for all our clients. It’s based on risk appetite, life age and stage, tax implications, and other factors, not purely the market. Dollar-cost averaging, market-linked notes, and reducing portfolio concentration are just a few ways we do this. As your fiduciary, we remain steadfast in carrying out our mission of letting your purpose fuel our passion. We are always here to discuss your financial plan, investments, and future goals. Please book an appointment anytime if you would like to talk.

[i] Blackhurst, C. (2023, March 24). Thenationalnews.com. Credit Suisse and SVB’s collapse remind us of what banks tend to get away with. [Online] Available at: Credit Suisse and SVB’s collapse remind us of what banks tend to get away with (thenationalnews.com)

[ii] (2023). Fidelity.com. Three charts on the benefits of staying invested. [Online] Available at: Three charts on the benefits of staying invested (fidelity.ca)