Budgeting a Better Way

What do you think of when you read the word budget? Do you associate it with reaching financial goals or does it stir up memories of not buying the pair of basketball shoes you wanted in college?

For many the word budget can carry negative connotations, evoking arguments with a spouse about overspending, or wishing you could allocate more to supporting the charities you believe in. No matter how you view the word, the reality is that a budget, when created thoughtfully and with intention, can become a vehicle that can help you move closer to your goals and aspirations.

In the financial industry, a budget is like a good friend you can trust. This friend allows you to have fun without going too far because they remind you of what you really want out of life. We have some tips and advice to share about creating budgets and using them to have constructive conversations with your whole family.

Tip #1

The first place to start with any budget is savings, let this be your first column. We like to think of it as paying our future selves. You can start small or really pinch your lifestyle but remember, your priority is to pay your bills and keep contributing to retirement plans. But saving is a great starting point.

Tip #2

Next, begin identifying your additional budget columns by tracking the following: income, expenses, spending, saving, and giving. If you are our client, you have access to a useful tool called eMoney that can make this step a little easier. Tracking is essential for having a clear and accurate view of exactly where your money is going. You can’t know how to change your spending until you first see where it’s going.

Tip #3

Family involvement in finances can be a tricky subject to navigate. If you are a high-net-worth individual, using a budget to talk about finances can be a great way of showing and telling your kids about money without disclosing your net worth. Inviting them to sit down with you as you pay household bills can help children see from a young age sound financial practice with open conversations around money. These moments can become key bricks in laying a good financial foundation.

Parents can also lead by demonstrating a healthy use of credit debt and encouraging children to do the same. For example, a healthy habit to model is only using a credit card when the balance can be paid off each month. Displaying this habit hopefully will teach your children to err on the side of caution when they use their credit card at college or click ‘pay’ on their iWatch.

Practical Application

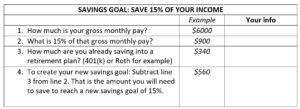

We thought rather than just create an article about budgeting it may be fun to have a budgeting exercise to practice. The mission: Save More, Spend Less.

Simply fill in the blanks with your information and personal savings % goal to start saving today!

P.S. Don’t forget to follow Tip #1 by setting this money aside before creating the rest of your budget.