Introducing Hidden Levers

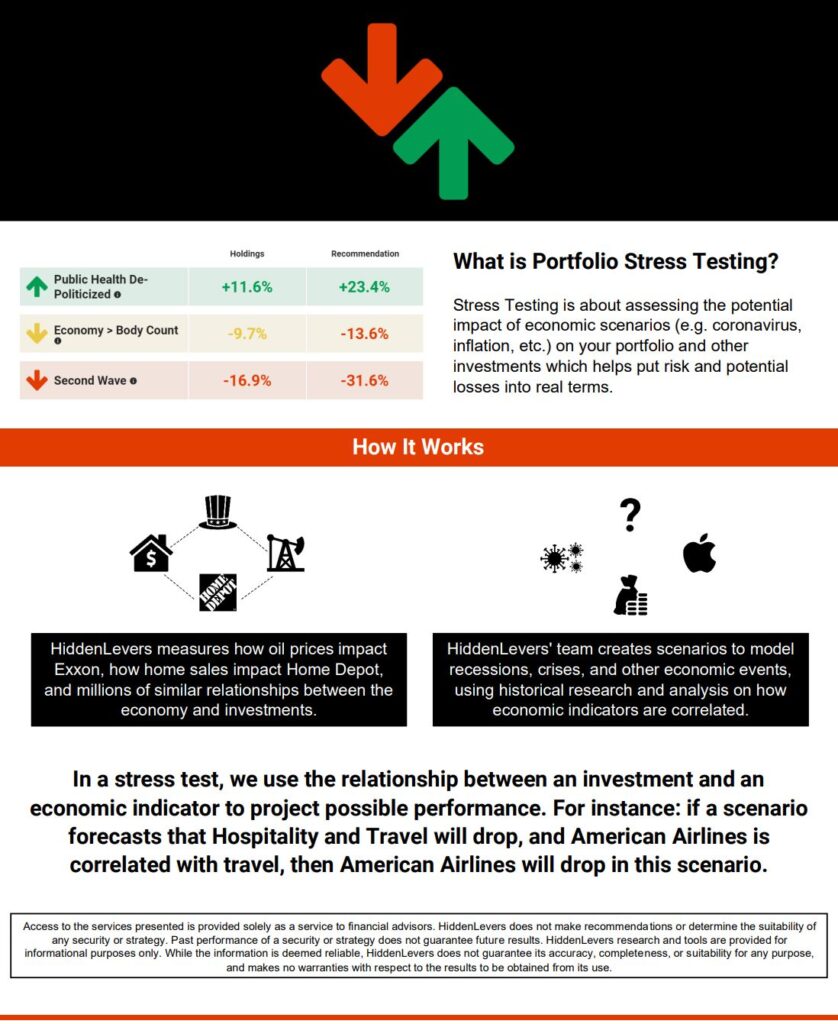

As technology changes and advances, Emerald Advisors looks for ways to keep serving our clients in ways that support our core value of being adaptable. One of those ways is adapting to new platforms or ways we can improve our services. Emerald Advisors sees Hidden Levers’s use of Portfolio Stress Testing as a valuable way to serve clients. What exactly is Portfolio Stress Testing you ask? Here’s a great graphic to help you understand:

Hidden Levers uses economic research, historical records, statistical data, and quantitative analysis to measure millions of relationships between the economy and investments. This platform also helps us ask the big ‘what-if’ questions many clients think, and sometimes even worry about. Using these elements can help us model the impact of multiple scenarios on a portfolio.

We always approach new technology from the standpoint of ‘how can this help Emerald better serve our clients?’ We believe Hidden Levers can add to our already sleek toolbelt and help us support clients through prudent guidance; this move also replaces Riskalyze with Hidden Levers. We want to continue to help clients make financial decisions with confidence regarding their retirement or helping pay for college tuition. Hidden Levers is a technology we believe will give us the ability to look at more ways to be adaptable when helping clients select the right portfolios for their individual needs.

If you have any questions or would like to find out more about Hidden Levers, please feel free to contact us.

Disclosure: Emerald Advisors, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.