529 Plans: Making Education a Priority

As a parent or grandparent, you may want to help your children/grandchildren start saving now for the cost of college tuition.

When planning, it is worth considering a 529 plan.

According to the SEC, a 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. 529 plans, legally known as “qualified tuition plans,” are sponsored by states, state agencies, or educational institutions and are authorized by Section 529 of the Internal Revenue Code. [1]

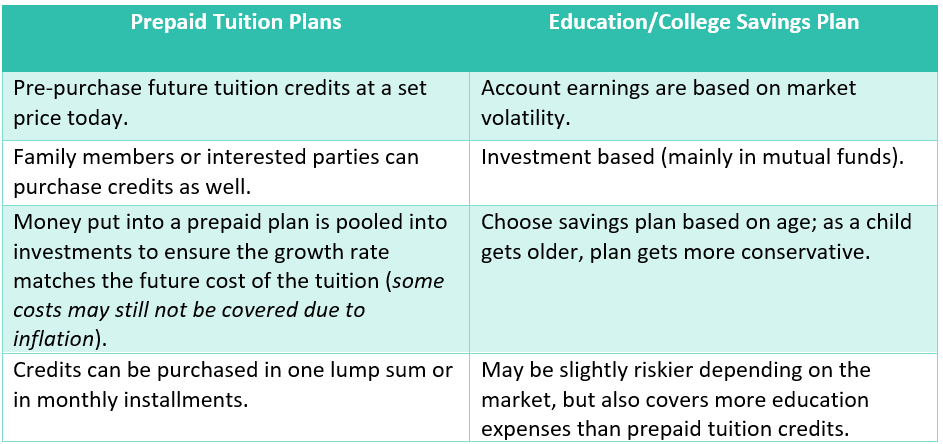

There are two types of 529 plans: prepaid tuition plans and education or college savings plans. Every state offers a state section plan, and both are free from federal income taxes.[2]

529 Plan Basics

When looking into 529’s it’s important to understand that each plan has unique benefits but you should review and understand your state’s options. Still, have more questions? Reach out to your Emerald Advisor today to discuss your options!

P.S. Additionally, we reviewed many sites and found www.collegesavings.org and SEC.gov | An Introduction to 529 Plans to be extremely helpful.

[1] U.S. Securities and Exchange Commission. (2018, May 29). SEC.gov.

[2] Section 529 Plans. (2021) FinAid.org.

[3] What is a 529 Plan? College Savings Plan Network.

Disclosure: Emerald Advisors, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.