Market Volatility

It’s been an interesting time for investors in U.S. stocks lately. Early May set a promising tone with the DJIA (Dow Jones) crossing the 40,000-point threshold for the first time in history. The SPX (S&P 500) and COMP (NASDAQ) indexes followed closely behind with a similar pattern, reaching new highs of their own. It was a strong outlook after April, which was referred to as “the worst [period] for big technology stocks since the COVID crash in 2020” (The Associated Press, 2024).

On May 30th, those optimistic expectations plummeted. The DJIA lost 330.06 points in a 3-day streak, SPX dropped 31.47 points, and COMP sank 183.50 points (MarketWatch). Wall Street’s expectations became complex—there was an overall average gain, but the sudden volatility reminded us of a pattern we’ve seen before.

Even Up Years For The S&P 500 Saw Intra Year Declines. Source: Bloomberg via Steer the Course for your Financial Future: A Guide for Long-term Investors, Bank of America. Data as of December 31, 2023. Past performance is no guarantee of future results. Please refer to index definitions at the end of this article. It is not possible to invest directly in an index.

It’s important to keep in mind that market volatility is an inevitable and normal part of investing. The stock market never stays still, as market indexes see gains and losses every day. When markets shift, particularly when they drop quickly, it can be hard not to react. And while heightened volatility can be a sign of trouble, it may actually be one of the keys to investing success—especially with a long-term investment strategy. With this in mind, we thought we’d share some insights on volatility and opportunities to mitigate its impacts.

What is Market Volatility?

Market volatility is the frequency and size of upward and downward price movements—the larger and more constant the price swings, the more volatile the market is. It is often misconceived as sharp, accelerated downward price movements in a market. However, sharp upward growth counts as volatility too.

Markets frequently encounter periods of heightened volatility, but most of the time, the stock market is fairly calm. Stock prices typically aren’t bouncing around back and forth. A long-term investment strategy can allow returns to be “less volatile [… with] returns over time [being] positive” (Raymond James, 2016). It provides a degree of insulation while allowing your portfolio to grow in rising market conditions.

Present Market Volatility & How to Respond

Currently, major U.S. stock indexes are rising, albeit at a slower pace on average due to occasional drops in larger-cap stocks—such as Salesforce (CRM), which dropped 21.6% in late May (Forbes). The markets are battling a higher interest rate environment, soaring inflation, heightened geopolitical risks, supply chain issues, and more. Interest rates have been a growing concern for investors, as the Fed has said they will “continue to hold interest rates at current levels for an extended period of time”. The slowing economic growth and continuation of interest rate levels have the potential to cause future downward volatility.

Here’s how you can insulate your portfolio against the impact of this risk:

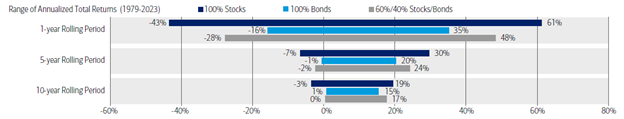

- Being Prepared – Focus on diversification and creating a balanced portfolio, which will help minimize the impact that any one trend (i.e. any of the factors listed above) has on your overall portfolio. This will result in smoothing out the overall experience. An example from BofA displaying a model 60/40 (60% Stocks/40% Bonds) is shown below:

A Balanced Portfolio Tends To See More Muted Declines Compared To An All Equity One. Source: Chief Investment Office, Bloomberg via Steer the Course for your Financial Future: A Guide for Long-term Investors, Bank of America. Stocks are represented by S&P 500. Bonds are represented by the Bloomberg U.S. Aggregate Bond Index. Cash is represented by the ICE BofA U.S. 3-month Treasury Bill Index. Based on monthly returns. Data as of December 29, 2023. Past performance is no guarantee of future results. Please refer to index definitions at the end of this report. It is not possible to invest directly in an index.

- Identifying Opportunities – Downward price volatility can be unsettling, but it can also create opportunities to invest for select long-term investors with certain risk tolerances and time horizons. Dollar-cost averaging is a strategy that investors can employ situationally to benefit from discounted asset prices.

Rebalancing your portfolios is another strategy you can implement to take advantage of market fluctuations. With upward price volatility, market fluctuations can cause a shift in how your assets are allocated (commonly referred to as ‘portfolio drift’), resulting in a very different asset mix than intended. As markets move, actively rebalancing portfolios to correct for drift creates a process of taking gains and investing in pulled back areas so you remain in line with your investment objectives. - Staying the Course – Ultimately, it’s important to keep in mind that long-term investing should trump short-term market trading over time and provide more opportunities for your portfolio to thrive. Investors who “maintain perspective” and stay mindful of their time horizon “have a better chance of reaching their investment goals than those who react to short-term market fluctuations” (Royal Bank of Canada, 2024).

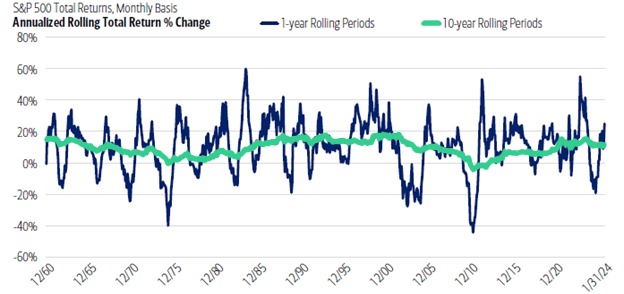

The Probability Of Positive Equity Returns Tends To Rise Over Longer Time Periods. Source: FactSet via Steer the Course for your Financial Future: A Guide for Long-term Investors, Bank of America. Data as of January 31, 2024. Past performance is no guarantee of future results. Please refer to index definitions at the end of this article. It is not possible to invest directly in an index.

Long-term investing can help you avoid emotional trading during falling markets and take advantage of growth during rising markets. Consider this: even amid significant setbacks such as the Great Depression in 1929, Black Monday in 1987, the tech bubble in 2000, and the financial crisis in 2008, investors would have experienced gains had they made an investment in the S&P 500 or Nasdaq 100 and held it over the long-term.

Market volatility can be unsettling (or even exciting), but it’s important to remain mindful of the purpose behind investing your money. History shows “you will more likely achieve your long-term investment goals if you have a plan and stick to it through all types of market conditions” (Royal Bank of Canada – Global Asset Management, 2024). Remember, volatility is part of the process, and a diversified portfolio is built to withstand such periods.

We have attached an article touching more on this topic and how a financial plan can provide you with a safety net and insulate your portfolio against volatility:

If you’d like to discuss the current market or your specific investments, please feel free to reach out to our team anytime.

Disclaimers: Securities indexes assume reinvestment of all distributions and interest payments. Indexes are unmanaged and do not take into account fees or expenses. It is not possible to invest directly in an index. Indexes are all based in U.S. dollars. S&P 500/Cumulative Price Return Index is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. Stocks/S&P 500 Annual Return Index is the investment return received each year, excluding dividends, when holding the S&P 500 index. S&P 500 Total Return Index is a type of equity index that tracks both the capital gains as well as any cash distributions, such as dividends or interest, attributed to the components of the index.

Please note the indices are not net of fees because there are no fees or expenses to deduct from an index. Index information is provided for general educational purposes and not as a comparison to the Adviser’s performance. Emerald Advisors, LLC may discuss and display charts, graphs, and formulas, which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

Emerald Advisors, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.