Navigating Your Future Wealth: RSUs & Vesting

by Megan Hannah

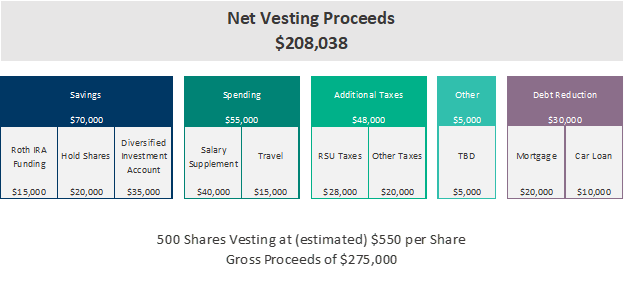

Today more than ever we see Restricted Stock Units (“RSUs”) playing a large role in our client’s compensation and wealth composition. Employees appreciate the stock grants but are often left unsure what to do with the shares once they vest – hold everything, sell everything, or something in between? At Emerald Advisors we work closely with clients to build a roadmap for RSUs based on purpose driven wealth management. Ahead of a large vesting, we meet with clients to formulate a plan for the shares that may look something like this:

We believe in selling shares for a purpose. That purpose will look different for each client and each situation. Some things to consider:

- Taxes – It is likely taxes will be owed on the vested shares above and beyond the automatic witholding. We typically recommend selling enough shares at vesting to cover the additional taxes and making an estimated tax payment. By selling at vesting there are no additional capital gains taxes. By making an estimated tax payment, clients ease the pain felt in April by paying the taxman when they are feeling more flush with cash.

- Salary Supplement – If clients are participating in a meaningful way in a deferred compensation plan they may need to sell some shares to cover living expenses as a result of their reduced salary. We recommend keeping 6 months of salary supplement on hand in cash or money market.

- Debt Reduction – Interest rates are high today. If a client is exposed to a variable rate loan (i.e., credit card debt, HELOC, etc.) it may make sense to sell a portion of shares to pay down the loan. With that said, understanding the type and rate of the loan is important. Many people have mortgages at 3% or less. When money market is paying 5% it often doesn’t make economic sense to accelerate payment of low interest loans.

- Diversification – As much as we want to believe in our company, holding a significant portion of one’s net worth in a single stock leads to idiosyncratic risk. While it can generate great wealth, it can also generate great pain – just ask Enron or Washington Mutual employees. Striking a balance between company loyalty and risk management is important. This may be achieved by selling a portion of shares either immediately or over time and moving those proceeds into a diversified investment portfolio.

There is no “one size fits all” solution for what to do with RSUs. We recommend working with a financial advisor before taking any action. The team at Emerald is always here to help.