Emerald’s Education Series: Diversification

The Power of Diversification

If you have spent much time speaking with the team at Emerald about investments, you have inevitably heard us speak of portfolio diversification. What does this mean? Why do we care? How does it play into your long-term plan?

Diversification is a fundamental principle that forms the bedrock of sound investment strategies. The practice of spreading investments across different assets helps mitigate risks, enhance returns, and create more resilient portfolios. Part of our job as your wealth manager is to build a diversified portfolio to accomplish these goals. We are not trying to hit home runs. We are seeking to reduce idiosyncratic risk – when a portfolio is well-diversified the performance of one investment is less likely to drastically impact the entire portfolio.

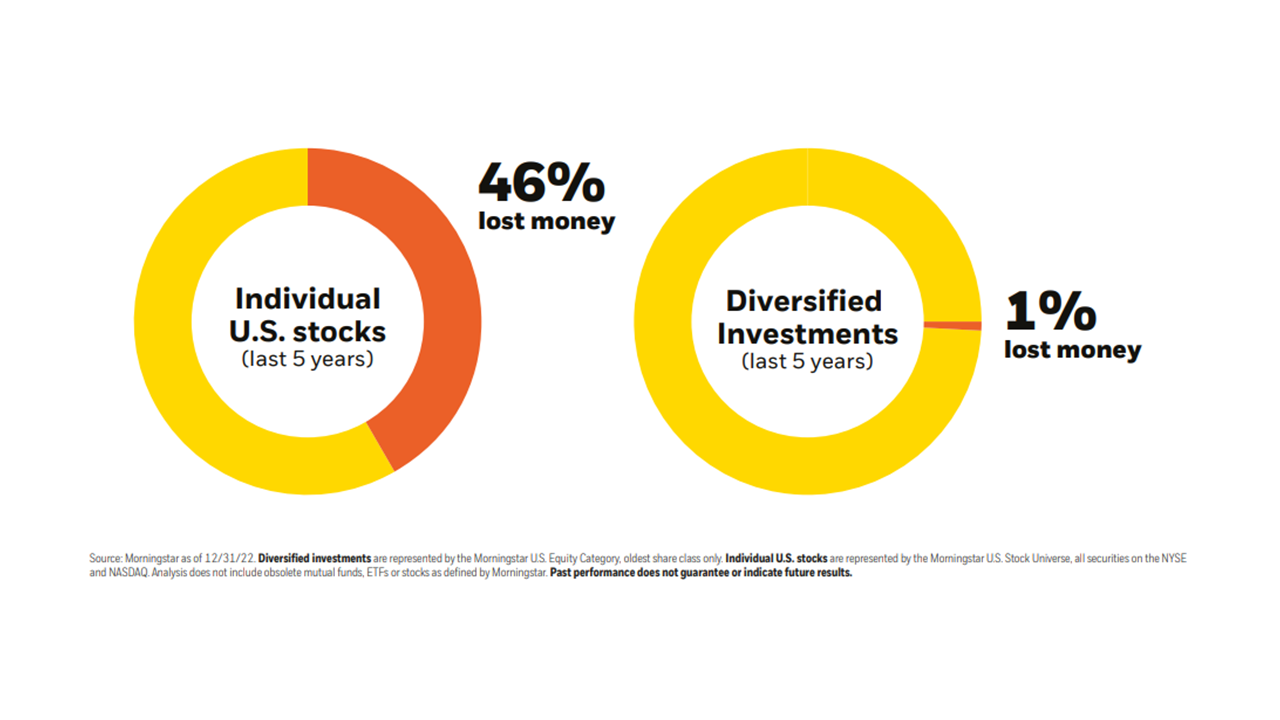

While we would all love to believe that we can pick the next Microsoft, Amazon or Costco, the reality is that for each of those success stories there are hundreds or even thousands of stories of failure. In a recent study, BlackRock found that over the last 5 years 46% of individual stocks lost money while only 1% of diversified investments lost money. Holding a diversified portfolio helps to balance the risk-return profile while seeking to safeguard against extreme volatility.

Markets are constantly changing, evolving and shifting. Diversification gives the investor exposure across assets so as one moves out of favor and another into favor you are not constantly playing catch up, you are already there. The increasing speed at which we are seeing economic cycles, technological advancements and political developments makes it ever more important to have a well-diversified portfolio that can adapt to those changes.

As with any investment approach, diversification requires thoughtful planning and periodic review. That is why Emerald Advisors is here. Tailoring a diversified portfolio to individual financial goals, risk tolerance, and time horizon is essential for long-term success. By embracing diversification, investors can build robust portfolios designed stand the test of time and help secure their financial future.