Emerald’s Education Series: Market Volatility and You

Emerald’s Education Series: Market Volatility and You

Where does volatility, specifically market volatility, stem from? This question is one many ask when the headlines are filled with debates taking place in Washington about the debt ceiling or when you replay some of the unprecedented events of the past few years. The unfolding of Covid and the ongoing war between Russia and Ukraine to the intense Fed rate hikes, tech layoffs, and banks collapsing captured our collective attention. No doubt, each event created degrees of market volatility. Understanding how these events cause levels of market volatility and impact your investments is essential.

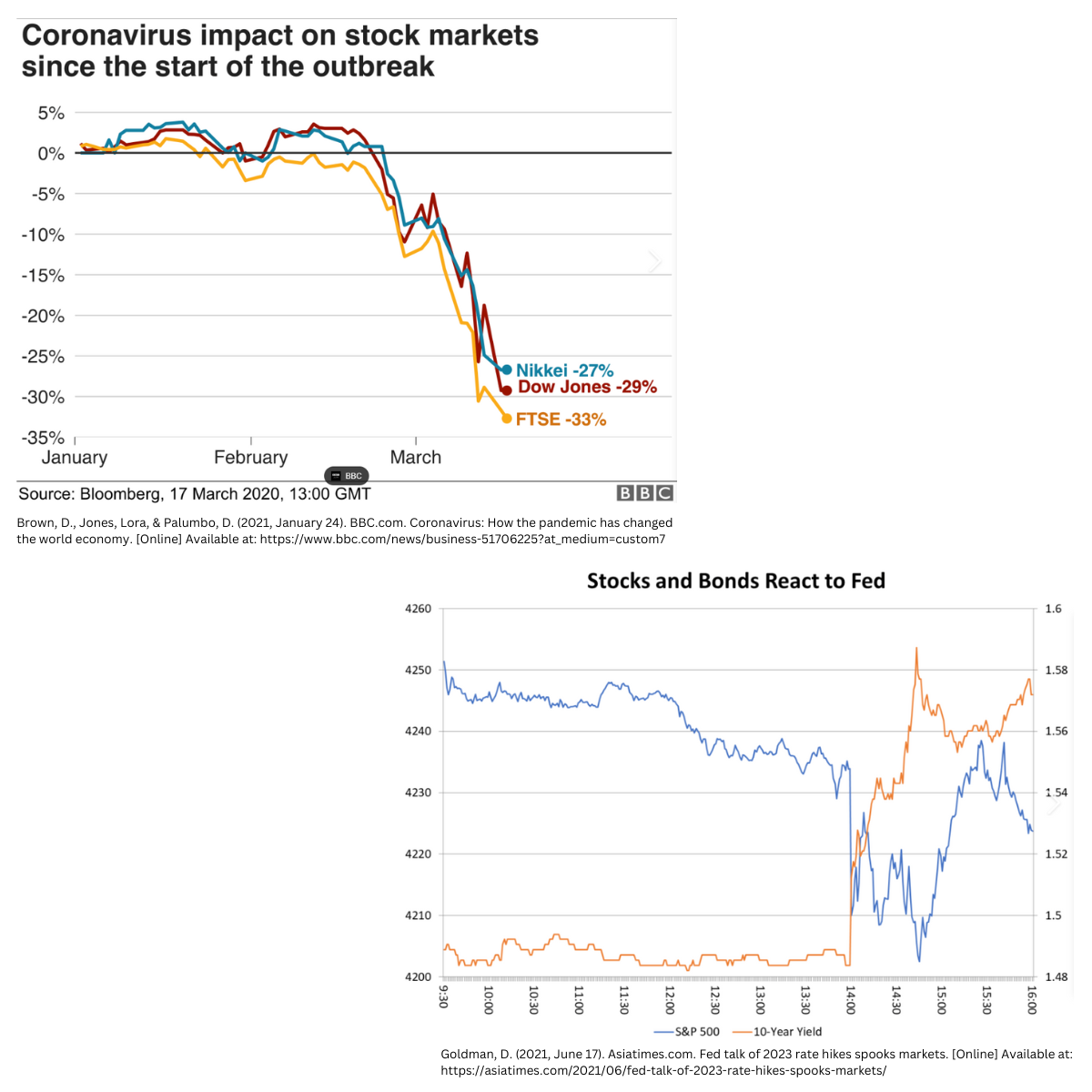

Let’s look at two recent events that have been ongoing in some capacity, causing up-and-down ticks in the market. First, this chart shows only a few months of the market’s response to Covid. As we all know, the market continued fluctuating as Covid stuck around, new variants popped up, and vaccines were created. These shifting lines gave quite the rollercoaster ride those first months and continued pretty consistently over the next couple of years.

*Image sources: (1) BBC.com, (2) Asiatimes.com.

Next, we will look at the image above, displaying the reaction of stocks and bonds to the Fed’s consistent rate hikes. Whenever Jerome Powell spoke or used specific words, the market and various types of investments responded like a spooked cat jumping sky high when startled. It seems that every time the Fed made an announcement, almost on cue, the market went a little haywire.

Understanding the impact

It’s important to remember that market volatility challenges nearly all investors. From individuals starting out, those approaching retirement, and folks in their golden years using Medicare, every age feels the ripples.

Below are a few ways investors of all stages may feel the impact of market volatility.

- Portfolio performance: For those approaching retirement, when volatility strikes, portfolio values can decline, directly impacting funds set aside for retirement. Others may have been invested in aggressive portfolios with higher levels of risk. When the market drops, that risk can feel more significant.

- Income-generating options can sometimes be more limited in retirement. Losing a steady flow of income can disrupt paying bills or maintaining a particular lifestyle. For others, reliance on specific streams of income has become the norm, and these moments definitely shake that reliance.

- Timed returns are crucial for many in retirement planning, and when they become negative returns, this can deplete assets that are harder to recover later down the road.

- Studies also show that there is a correlation between wealthy clients and life span, meaning funds need to last longer. So if you find yourself in that category now, you may remain there and need to anticipate more funds to support you in later years.

How to reduce the impact

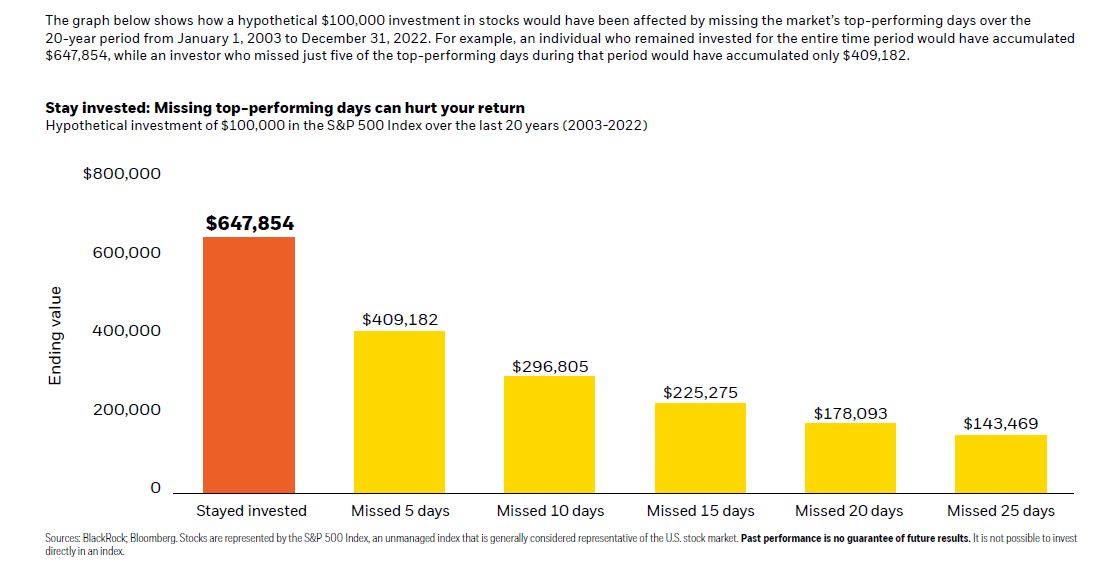

One thing is sure; there will always be volatility. But staying invested for the long term is a best practice to follow. We consistently remind clients not to let emotions drive the investing car. If you respond to volatility with pure emotions, you may miss out on top-performing days and significantly reduce your investment. The image below drives this point home.

There are multiple tactics to consider to help reduce the impact of market volatility on your investments.

- Diversification will remain an excellent tactic for protecting assets. Avoiding concentration is vital to a well-balanced financial plan. Emerald is well-versed in ensuring clients understand their concentration level and find what they feel comfortable with. This method of asset protection looks different for every stage of life, and working with Emerald can be a valuable resource to help you navigate this terrain.

- Annual reviews with Emerald help clients understand their position and see where adjustments may need to be made based on overall market volatility.

- Risk management becomes a narrower focus as you get older. Avoiding higher-risk investments at the appropriate times can be a good strategy.

- Alternative investments can add portfolio depth and may avoid the full impact of volatility the market feels.

- Including strategies such as dollar-cost averaging either every month or every year as just one practice to stick with can help your overall outcomes when things get shaky.

- Maintaining appropriate cash reserves can also be helpful during market downturns, allocating investments to return without selling low. Keeping your cool during market volatility will also help you remain invested for the long term. Reacting to the market is not a good idea; keeping long-term goals and objectives in mind and allowing those to motivate decisions is critical.

Understandably market volatility can cause stress levels to rise, especially as you get older and closer to retirement or are already retired. For high-net-worth clients, there are special considerations to keep in mind. But having a plan, working with Emerald to evaluate your position each year, and keeping your emotions in check will all serve you well. Remember, Emerald is here to help, so reach out anytime.