Long Term Care Trust Act: Know Your Options

THE WASHINGTON STATE LONG TERM CARE TRUST ACT:

KNOW YOUR OPTIONS AND ACT TODAY

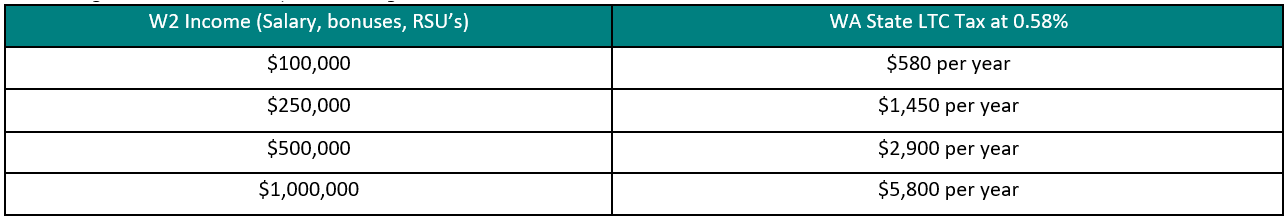

At Emerald Advisors we aim to give honest, unbiased advice to clients and that includes the impact of the Washington State Long Term Care (“LTC”) Trust Act on all Washington State clients. The LTC Act passed in July 2019 with payroll deductions beginning January 2022. There is a limited time to opt-out. For those choosing to opt-out, you must have LTC insurance in place by November 2021 and apply to opt-out starting October 1, 2021 otherwise you will be subject to this payroll tax indefinitely

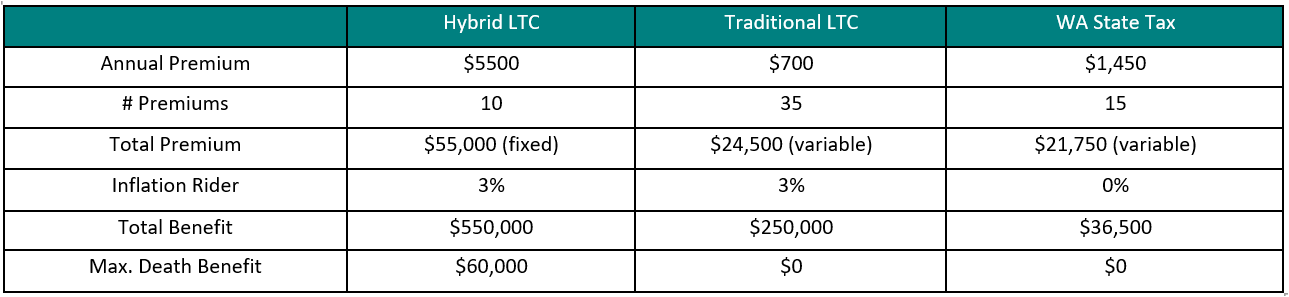

As advisors, we believe in the power of choosing what your future care will look like and work with our clients to establish LTC insurance. Attached is a comparison sheet reviewing the characteristics and benefits of a hybrid LTC policy, a traditional LTC policy and the Washington State tax. In addition, the table below provides a basic hypothetical overview of anticipated costs and benefits for each option (based on a married 50-year-old making $250k/year until age 65 and receiving benefits at age 85):

WHAT OPTION IS BEST FOR YOU?

Book an LTC appointment with Emerald Advisors today. Together we will review your situation and what option is best for your future. As this pertains to all Washington state residents, please share with your family, friends, and colleagues.

*Disclaimer: This information is for educational purposes only and is not a recommendation to buy, sell, or make any changes concerning the purchase or retention of a Long Term Care Policy. Insurance costs and benefits represent hypothetical estimates and are not a final offer. Actual costs and benefits will vary by individual and policy. It does not take into account the specific investment objectives, tax and financial condition or particular needs of any specific person. Investors should work with their financial professionals to discuss their specific situation. Federal income tax laws are complex and subject to change. The information in this email is based on Emerald Advisors’ current interpretation of legislation RCW 48.83.020 and is not guaranteed to reflect all amendments to the current law.